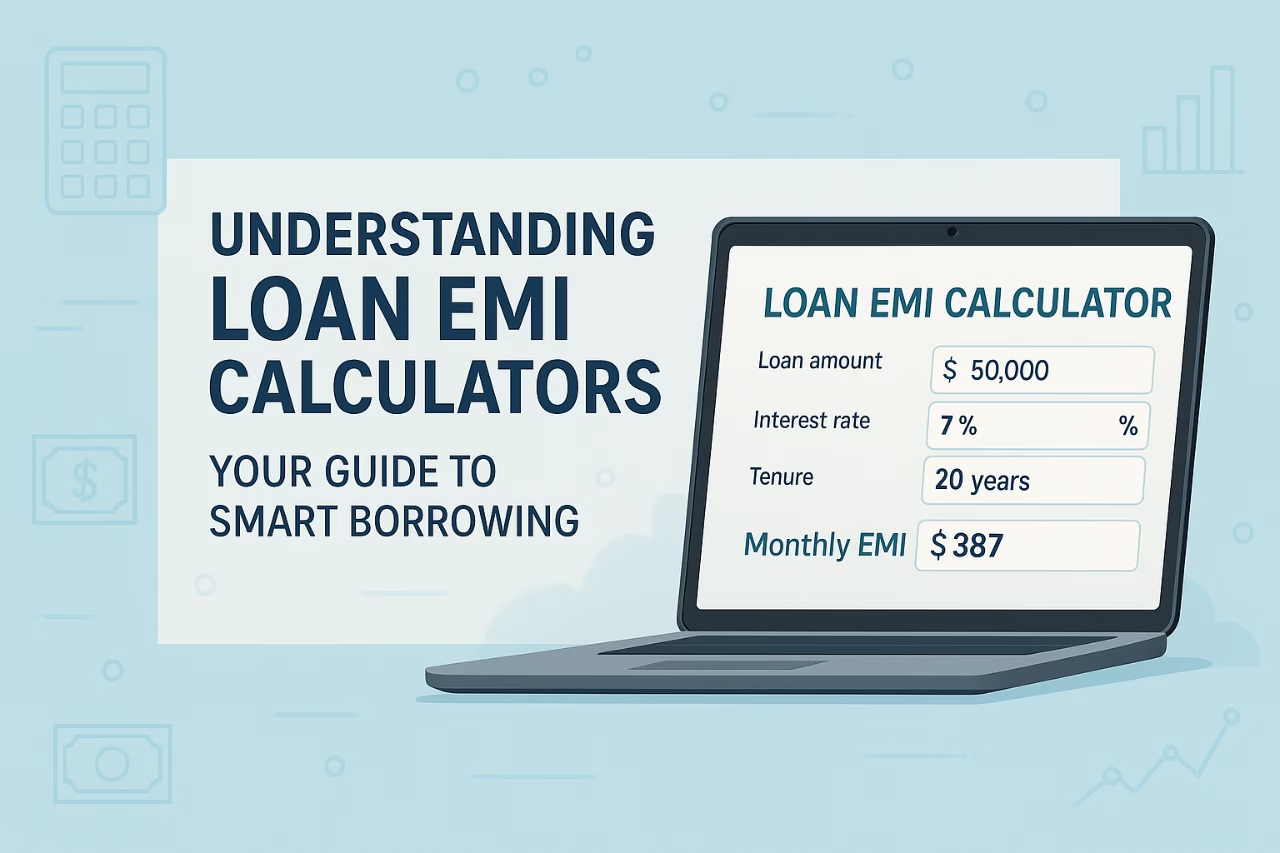

A Loan EMI Calculator is a powerful tool that helps borrowers plan their finances by estimating monthly loan repayments. Whether you’re considering a home loan, car loan, or personal loan, an EMI calculator simplifies the process of understanding your financial commitments. By inputting details like loan amount, interest rate, and tenure, you can instantly see your monthly EMI, total interest, and overall repayment. This article explores how an EMI calculator works, its benefits, and tips for using it effectively to make informed borrowing decisions.

Indian Loan EMI Calculator

Calculate your Equated Monthly Installment (EMI) for home, car, or personal loans with current Indian market rates.

What is a Loan EMI Calculator?

An EMI, or Equated Monthly Installment, is the fixed amount you pay monthly to repay a loan. A Loan EMI Calculator is an online tool that computes this amount based on three key inputs: the principal loan amount, the interest rate, and the loan tenure. The calculator uses a standard EMI formula to provide accurate results, helping you understand your monthly obligations. Most banks and financial websites offer free EMI calculators, making it easy to plan your loan repayment without manual calculations.

How Does an EMI Calculator Work?

Using an EMI calculator is simple and user-friendly. You enter the loan amount, interest rate, and repayment period, and the tool does the rest. The formula for EMI calculation is:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Where:

- P = Principal loan amount

- R = Monthly interest rate

- N = Number of monthly installments

This formula accounts for both principal and interest, ensuring your monthly payments remain consistent. The calculator instantly displays your EMI, total interest payable, and the overall loan cost.

Benefits of Using a Loan EMI Calculator

An EMI calculator offers several advantages for borrowers:

- Time-Saving: Get instant results without complex manual calculations.

- Financial Planning: Understand your monthly EMI to budget effectively.

- Compare Loans: Test different loan amounts, tenures, and interest rates to find the best option.

- Transparency: See the total interest and repayment amount upfront.

- Error-Free: Avoid mistakes in calculations for accurate planning.

These benefits make the Loan EMI Calculator an essential tool for anyone considering a loan.

Tips for Using an EMI Calculator Effectively

To get the most out of an EMI calculator, follow these tips:

- Accurate Inputs: Ensure you enter the correct loan amount, interest rate, and tenure.

- Experiment with Tenures: Try different repayment periods to balance EMI affordability and total interest.

- Check Interest Rates: Compare rates from multiple lenders for the best deal.

- Include Processing Fees: Some calculators allow you to factor in additional costs like processing fees.

- Plan for Prepayments: If you plan to prepay, check how it affects your EMI or tenure.

Using these strategies, you can tailor your loan to fit your financial goals.

Why Use an EMI Calculator Before Borrowing?

Before taking a loan, knowing your EMI helps you assess affordability. A Loan EMI Calculator shows how different loan terms impact your monthly budget. For example, a longer tenure reduces your EMI but increases total interest, while a shorter tenure saves on interest but raises monthly payments. By experimenting with the calculator, you can find a balance that suits your income and expenses. This proactive approach prevents financial strain and ensures timely repayments.

Common Mistakes to Avoid

While using an EMI calculator, avoid these pitfalls:

- Ignoring Additional Costs: Loans may include processing fees or taxes not reflected in the EMI.

- Incorrect Inputs: Double-check your loan details to ensure accurate results.

- Focusing Only on EMI: A low EMI might mean a longer tenure and higher interest.

By being mindful, you can use the calculator to make well-informed decisions.

FAQs

What is a Loan EMI Calculator?

A Loan EMI Calculator is an online tool that calculates your monthly loan repayment based on the loan amount, interest rate, and tenure.

Is an EMI calculator accurate?

Yes, an EMI calculator provides accurate results if you input correct details. However, additional fees like processing charges may not be included.

Can I use an EMI calculator for all loans?

Yes, you can use an EMI calculator for home loans, car loans, personal loans, or any fixed-rate loan.

How does tenure affect EMI?

A longer tenure lowers your EMI but increases total interest, while a shorter tenure raises EMI but reduces interest.

By using a Loan EMI Calculator, you gain clarity and control over your loan repayment journey, ensuring smarter financial decisions.