Best Stock Analysis Websites India: Ready to build wealth? India’s stock market is booming, and it’s open to everyone—from students to professionals. But here’s the catch: it’s also volatile. Investing without analysis is like playing cricket blindfolded! The best stock analysis websites India give you the tools, data, and confidence to make smart moves, whether you’re a beginner or a pro.

Must Read-

Why Stock Analysis Is a Game-Changer

A single news headline or RBI policy can shake stock prices. Stock analysis helps you:

- Spot Trends: Catch patterns like candlesticks or breakouts.

- Reduce Risk: Pick solid companies with strong financials.

- Stay Sharp: Keep up with news and expert insights.

Whether you’re buying Reliance shares or trading Nifty options, these tools will level up your game. Best part? Many are free! Here are the top platforms to get you started.

Top 10 Best Stock Analysis Websites in India

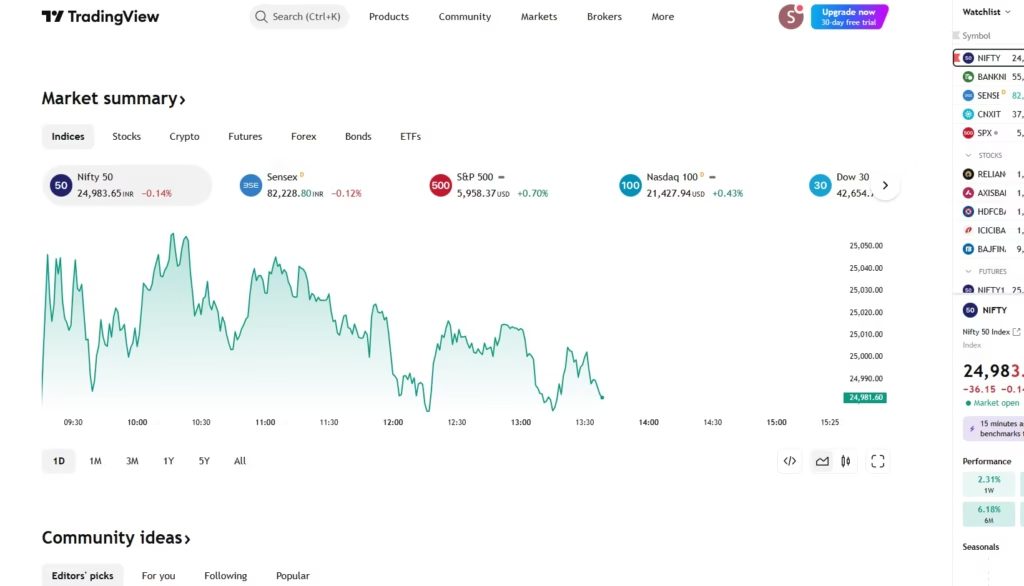

1. TradingView – The Trader’s Best Friend

TradingView stands out as a global charting powerhouse that’s perfectly tailored for Indian traders, syncing seamlessly with the NSE and BSE. It’s a haven for anyone who loves technical analysis, offering smooth, customizable charts and over 100 indicators like RSI, MACD, and Bollinger Bands. Whether you’re a day trader watching one-second price ticks or a swing trader studying monthly trends, this platform adapts to your needs. What makes it truly special is its community—you can peek into the strategies of pro traders worldwide and even copy their setups to sharpen your skills.

Best For: Day traders and swing traders.

Pricing: Free (3 indicators); Pro plans from ₹1,200/month.

Pro Tip: Use multi-chart view to track Nifty and stocks together.

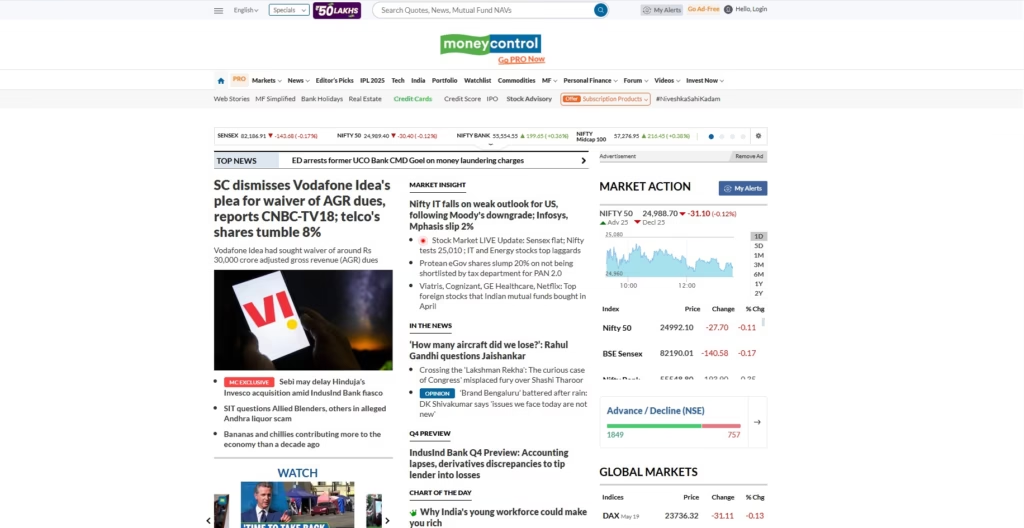

2. Moneycontrol – Your All-in-One Hub

Moneycontrol has earned its reputation as India’s go-to financial hub, blending real-time market updates with a wealth of data. It’s like having a financial newspaper, stock tracker, and analyst rolled into one. You get live updates on the Sensex and Nifty, detailed stock pages with news, financials, and corporate announcements, plus technical charts featuring indicators like Bollinger Bands. The “Market Edge” feature is a gem, pulling trade calls from big names like Kotak and ICICI Direct, so you can see what the experts think without jumping between sites. It’s mostly free, though some advanced tools come with a premium tag, making it ideal for those who crave both news and numbers.

Best For: Investors wanting news and data in one place.

Pricing: Free; premium for extra tools.

Pro Tip: Compare companies like Infosys vs. TCS with the “Compare” tool.

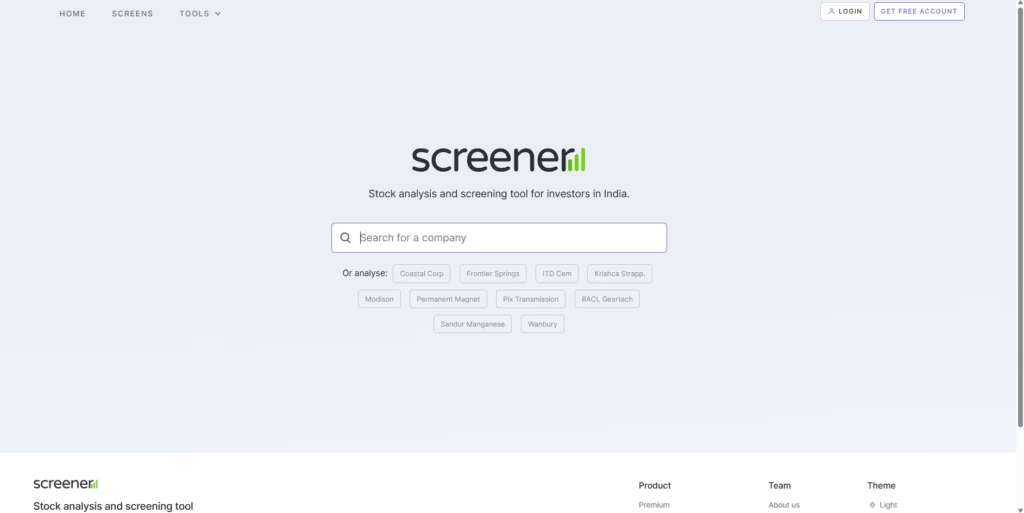

3. Screener.in – Fundamental Analysis King

This platform lets you slice and dice financial data with ease—think of it as a detective’s toolkit for stocks. You can create custom filters, like finding companies with a ROCE above 15 and low debt, and it scans thousands of stocks in seconds. It serves up over a decade of financial statements, all exportable to Excel, and its peer comparison charts show how a company stacks up against rivals. A Hyderabad investor once used it to spot undervaluation in Asian Paints, reaping a 40% gain in months.

Best For: Long-term investors digging into balance sheets.

Pricing: Free; premium at ₹2,499/year.

Pro Tip: Screen for high-ROCE stocks like Asian Paints.

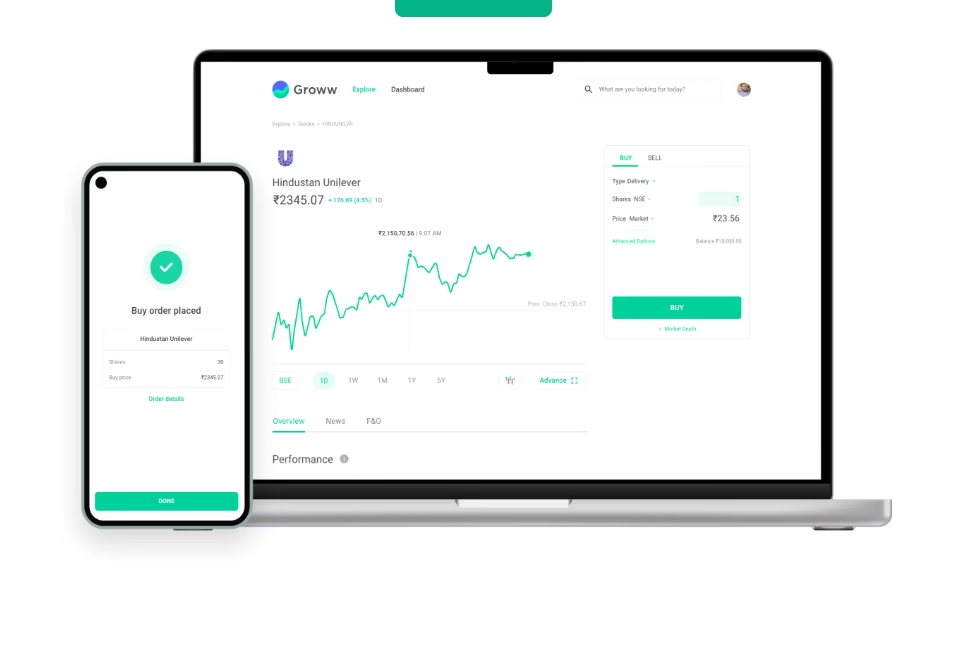

4. Groww – Beginner’s Buddy

Groww has captured the hearts of India’s younger investors with its simple, no-nonsense approach. Originally a mutual fund platform, it’s now a welcoming space for beginners to explore stocks. Instead of overwhelming you with complex charts, it offers straightforward stock reports with essentials like P/E ratios and market cap, plus a “Learn” section that breaks down concepts like SIPs and ETFs in plain language. You can track your investments across stocks, mutual funds, and even digital gold, all in one clean interface.

Best For: First-time investors.

Pricing: Free with brokerage account.

Pro Tip: Start small with SIPs in stocks like HDFC Bank.

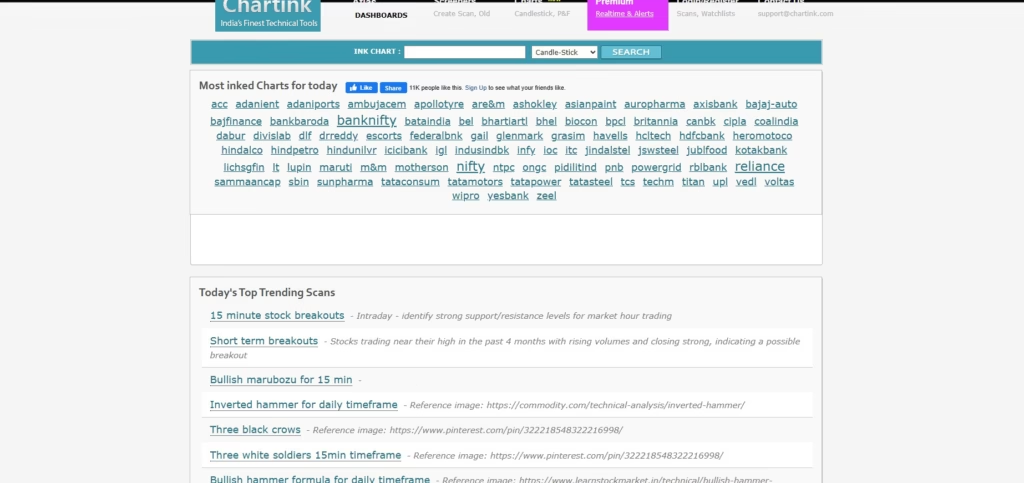

5. Chartink – Simple Technical Scans

Chartink takes the complexity out of technical analysis, making it a great choice for newcomers to trading. You don’t need to be a coding whiz—just pick from pre-built screeners for patterns like RSI Overbought or MACD Crossovers, and it scans the NSE in real-time for you. It’s like having a personal assistant flag potential trades, complete with alerts for price breakouts. There’s even a backtesting feature to test your ideas.

Best For: New traders learning patterns.

Pricing: Free; premium for real-time alerts.

Pro Tip: Use the “Bullish Engulfing” screener for stocks like Maruti Suzuki.

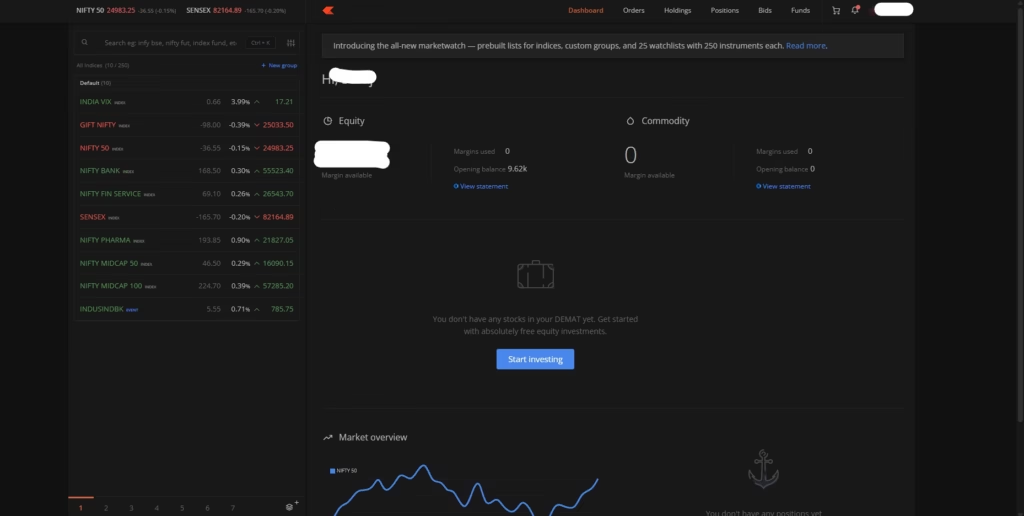

6. Zerodha Kite + Console – Trade and Analyze

Zerodha’s Kite and Console combo is a dream for its users, blending fast trading with smart analytics. Kite delivers a zippy trading platform with top-tier charting from TradingView and ChartIQ, so you can analyze and trade without missing a beat. Console steps in with detailed reports—think P&L breakdowns, tax-ready summaries, and SIP visuals—plus a handy margin calculator for intraday or F&O moves. For Zerodha clients, it’s a seamless experience, and pairing it with Streak for automated trading takes it up a notch.

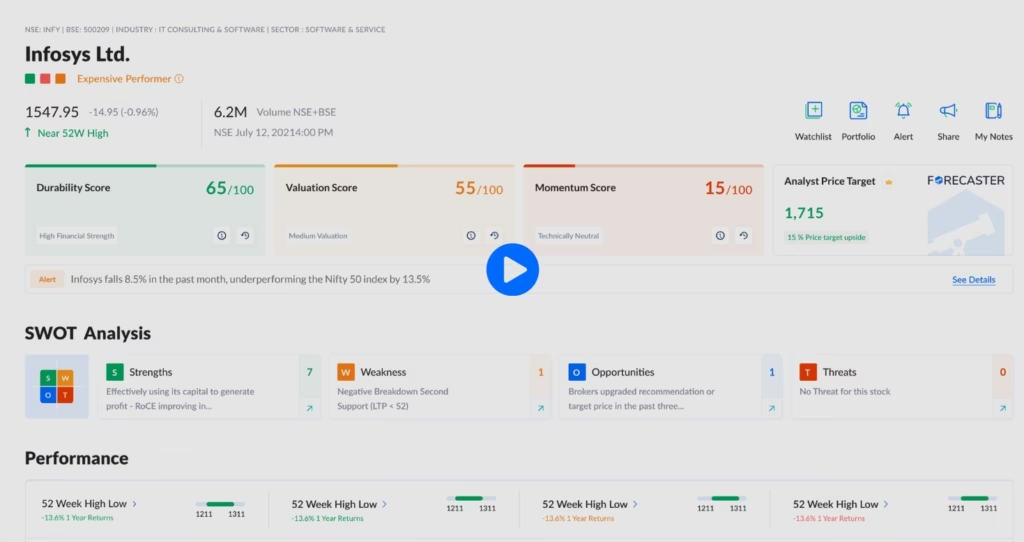

7. Trendlyne – Value Investor’s Guide

Trendlyne caters to value investors who want more than just surface-level data. It dives deep into fundamentals with tools like discounted cash flow analysis and Graham’s Formula, while also tracking insider moves like bulk deals and promoter pledges. Its “Power Trends” and “Forecast” features help spot momentum or undervalued gems before a big run. Alerts for shareholding changes add an extra layer of insight.

Best For: Buffett-style investors.

Pricing: Free; premium for advanced tools.

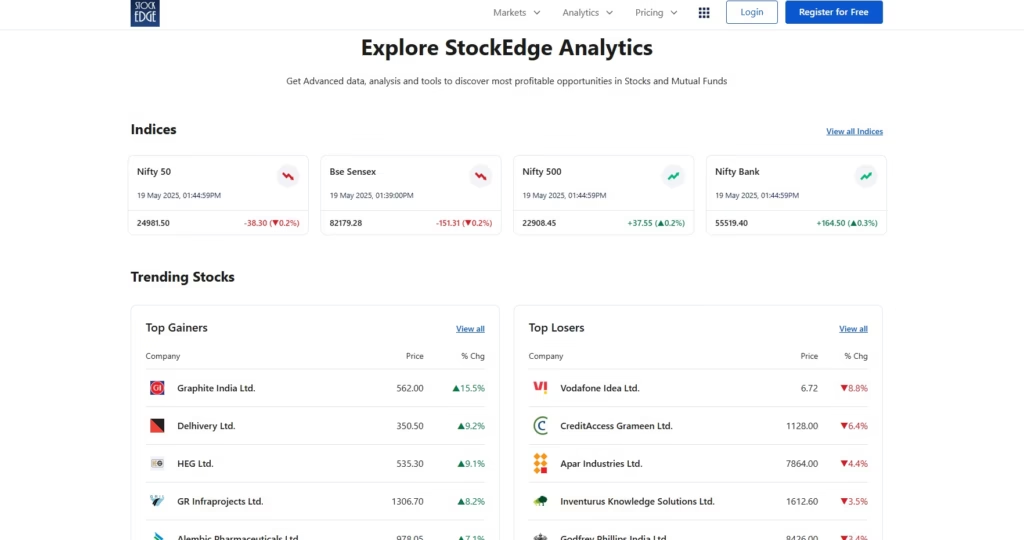

8. StockEdge – Real-Time Action

StockEdge is built for action, keeping active traders in the loop with real-time alerts. It shines at spotting candlestick patterns like Hammers or Shooting Stars, alongside volume shockers and breakouts. Daily scans reveal FII activity and insider buying, giving you a heads-up on market moves. Imagine catching a stock on a “Bullish Engulfing” pattern with rising volume—StockEdge flags it fast.

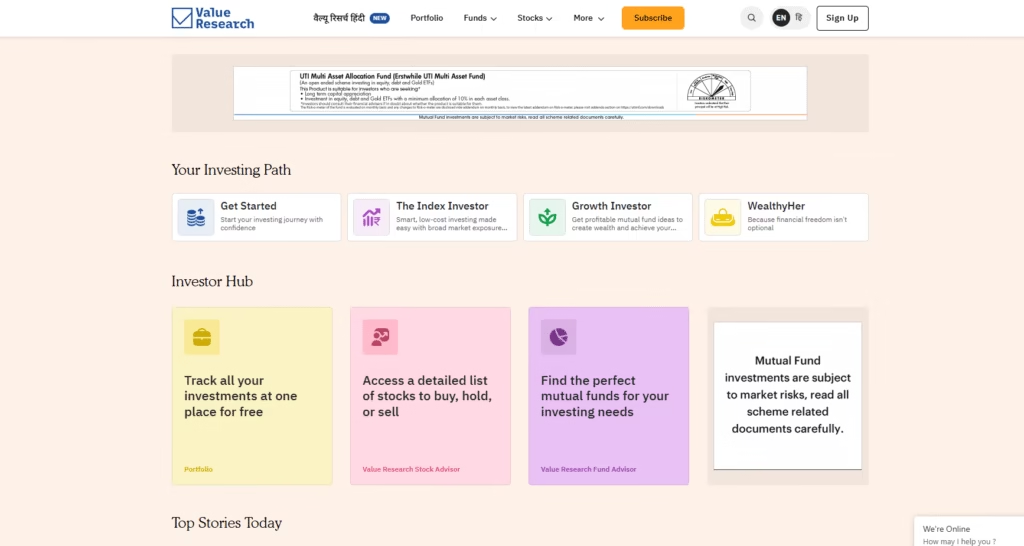

9. Value Research Online – Mutual Fund Master

Value Research Online is the ultimate companion for mutual fund investors, offering clear ratings from 1 to 5 stars across thousands of schemes. It helps you compare funds, check portfolio overlap (so you’re not doubling up on HDFC Bank), and dive into asset allocation details. For SIP investors or retirees balancing risk and reward, its straightforward reports and visuals make decision-making a breeze. Free to use with premium upgrades available, it’s a trusted tool for anyone building a diversified mutual fund portfolio.

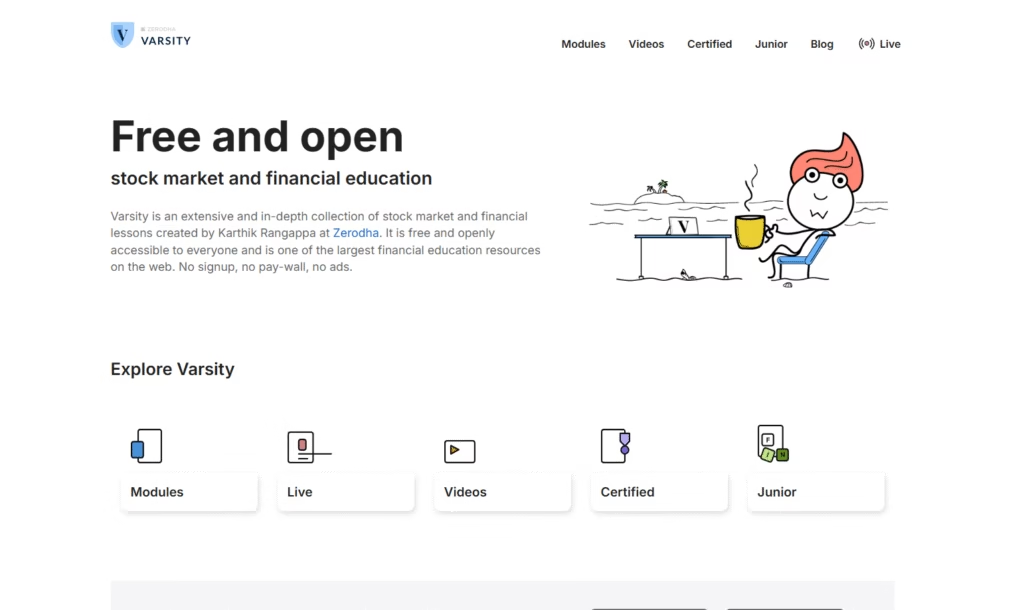

10. Zerodha Varsity – Learn for Free

Finally, Zerodha Varsity offers a free education goldmine, turning beginners into confident investors. With over 12 modules—covering everything from technical analysis to taxes—it’s packed with quizzes and jargon-free lessons. The “How to Read an Annual Report” module, for instance, simplifies dissecting companies like TCS. No ads, no upsells—just pure learning. It’s the perfect starting point for students, professionals, or anyone curious about the market.

Tips to Pick the Right Platform

- Free or Paid? Free tools like Chartink and Screener.in are powerful. For daily traders, premium plans (e.g., TradingView’s ₹1,200/month) are worth it.

- SEBI Registration: Ensure platforms giving stock tips are SEBI-registered. Data-driven sites like Trendlyne are safe bets.

- Your Goal: Swing trading? Try TradingView or Chartink. Long-term? Go for Screener.in or Trendlyne. Newbie? Start with Groww or Varsity.

Pro Tip: Build a toolkit—Moneycontrol for news, TradingView for charts, Screener.in for financials, and Varsity for learning. Start free and scale up!

Conclusion – Kickstart Your Wealth Journey!

Stock analysis isn’t just for pros—anyone can master it! These 10 websites give you the tools to make smart, confident decisions.

Take action now! Try free versions, build your toolkit, and check out our guide for more investing tips. Join the Bullish Bunch community for daily market insights and start building your wealth today!

FAQs

Best platform for beginners?

Groww is simple; Zerodha Varsity offers free learning.

Is TradingView’s ₹1,200/month worth it?

Yes for active traders; the free version works for casual users.

How to avoid fake stock tips?

Stick to SEBI-registered platforms or data-driven sites like Trendlyne.

Can free tools support serious investing?

Absolutely! Chartink, Screener.in, and Varsity are free and powerful.